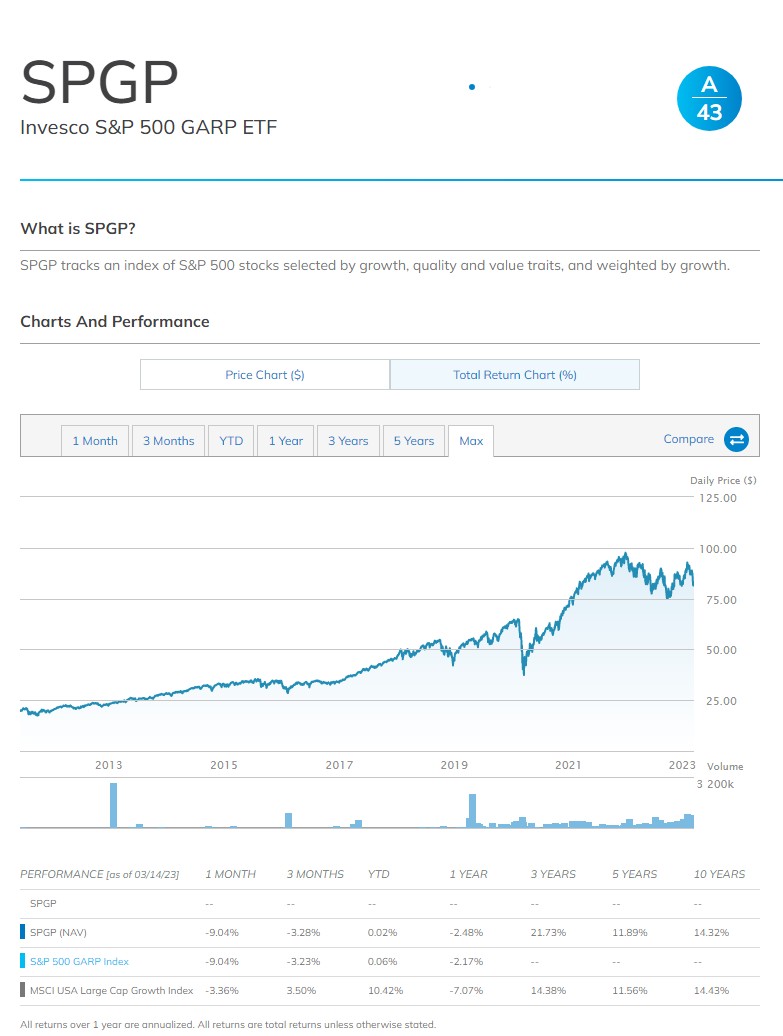

피터린치식 GARP전략을 추종하려면 GARPindex 추종지수를 트렉킹하는 SPGP ETF를 보면된다.

SPGP seeks growth stocks that also contain quality and value traits, or growth at a reasonable price. Starting from the S&P 500, the underlying index selects 150 names with the highest growth score, derived from trailing 3-year earnings to price growth and sales to price growth. It then picks the top half of these based on a quality and value score, using financial leverage ratio, return on equity and earnings to price. The resulting 75 names are weighted by the growth score. The underlying index undergoes semi-annual rebalance and reconstitution, subject to certain constraints. The maximum weight of each security is 5% while the maximum weight of any given GICS sector is 40%. Prior to June 24, 2019, the fund tracked a Russell pure growth index (perhaps the opposite of GARP in growth context) under a different name and ticker (PXLG).

인베스코/11년 6월 16일 출시/수수료 0.36%/ $2.58b자산운용/ 추종지수, S&P 500 GARP Index

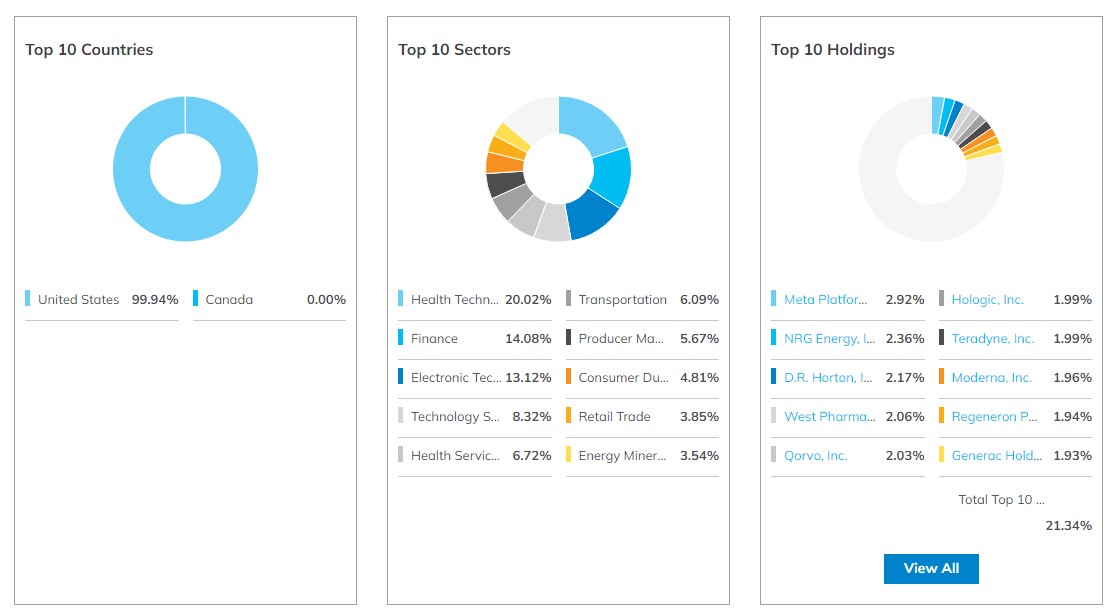

미국종목이 100% / 섹터는 IT,금융,전자 순.. TOP 10비중은 21% 정도되며 종목은